Mordica Company Standard Labor Cost is a fundamental concept in manufacturing that establishes a benchmark for labor expenses. This detailed analysis delves into its definition, components, establishment process, operational impact, and industry comparisons, providing valuable insights for optimizing production efficiency.

Definition of Mordica Company Standard Labor Cost

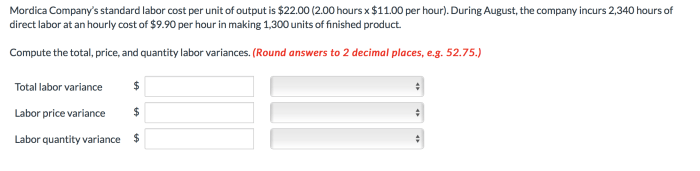

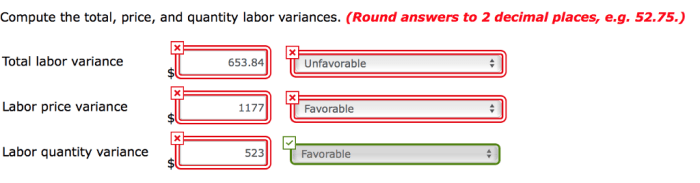

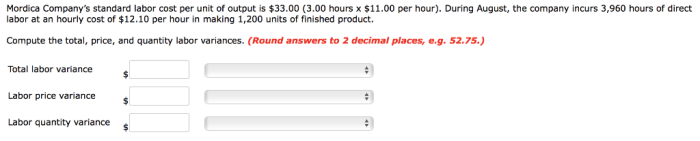

Standard labor cost is a predetermined estimate of the labor cost required to produce a unit of output. It is based on the time and motion studies and takes into account factors such as the efficiency of the workforce, the production process, and the materials used.

Mordica Company defines its standard labor cost as the amount of direct labor required to produce a unit of output, multiplied by the standard labor rate. The standard labor rate is the average hourly wage of the workforce, including fringe benefits.

Significance of Standard Labor Cost

Standard labor cost is a critical element of manufacturing cost accounting. It is used to:

- Estimate the cost of production

- Control labor costs

- Evaluate the efficiency of the workforce

Components of Mordica Company Standard Labor Cost

Mordica Company’s standard labor cost comprises various components that determine the total labor cost associated with producing a unit of output. These components include:

Standard Labor Hours

Standard labor hours represent the estimated amount of time required to complete a production task or operation efficiently. They are determined through time studies, work sampling, or historical data analysis. Factors influencing standard labor hours include:

- Task complexity

- Equipment efficiency

- Worker skill level

- Production methods

Standard Labor Rate

The standard labor rate is the hourly wage or salary paid to workers for performing standard labor tasks. It is influenced by factors such as:

- Industry and regional wage rates

- Worker experience and skill level

- Union contracts

- Government regulations

Fringe Benefits

Fringe benefits are additional compensation paid to workers beyond their base wage or salary. They include items such as health insurance, paid time off, and retirement contributions. The cost of fringe benefits is typically expressed as a percentage of the standard labor rate.

Process for Establishing Mordica Company Standard Labor Cost

Mordica Company’s standard labor cost is established through a comprehensive process involving multiple departments and utilizing various data collection and analysis methods.

The process begins with the Industrial Engineering department conducting time and motion studies to determine the standard time required to complete each task within the production process. These studies involve observing and recording the movements and activities of workers, analyzing the efficiency of the process, and identifying potential areas for improvement.

Data Collection and Analysis

The collected data is then analyzed to determine the standard labor cost for each task. This analysis considers factors such as the skill level of the workers, the complexity of the task, and the availability of resources. The Human Resources department provides information on labor rates and benefits, while the Production department provides data on production schedules and capacity.

Standard Labor Cost Setting

Based on the analyzed data, the Cost Accounting department establishes the standard labor cost for each task. This cost is then used for planning, budgeting, and performance evaluation purposes. Regular reviews and updates are conducted to ensure that the standard labor cost remains accurate and reflects changes in the production process or labor market conditions.

Impact of Standard Labor Cost on Mordica Company’s Operations

Standard labor cost serves as a crucial element in Mordica Company’s operations, influencing production planning, cost control, and performance evaluation. By establishing predetermined labor costs, the company can effectively plan and allocate resources, set realistic production targets, and evaluate the efficiency of its workforce.

Production Planning and Control

Standard labor costs provide a benchmark against which actual labor costs can be compared. This allows Mordica Company to identify variances and take corrective actions to minimize deviations from the standard. By monitoring labor efficiency, the company can optimize production processes, reduce waste, and improve overall productivity.

Budgeting and Cost Control

Standard labor costs form the basis for budgeting and cost control. By establishing standard costs, Mordica Company can forecast labor expenses accurately and allocate resources efficiently. Variances between standard and actual labor costs highlight areas where cost savings can be achieved, enabling the company to implement cost-reduction initiatives.

Performance Evaluation

Standard labor costs serve as a valuable tool for performance evaluation. By comparing actual labor costs to standard costs, Mordica Company can assess the efficiency of its employees and identify areas for improvement. This data can be used to reward high performers, provide targeted training, and motivate the workforce to achieve higher productivity levels.

Opportunities for Improvement and Cost Reduction, Mordica company standard labor cost

Regularly reviewing and analyzing standard labor costs presents opportunities for improvement and cost reduction. Mordica Company can identify areas where labor costs exceed the standard, investigate the underlying causes, and implement corrective measures. This continuous improvement process enables the company to optimize labor utilization, reduce waste, and enhance overall cost-effectiveness.

Comparison of Mordica Company’s Standard Labor Cost with Industry Benchmarks: Mordica Company Standard Labor Cost

Mordica Company’s standard labor cost should be compared with industry benchmarks and best practices to assess its efficiency and competitiveness. Identifying areas for improvement can help Mordica Company align its standard labor cost with industry standards.

Identifying Areas for Improvement

By comparing Mordica Company’s standard labor cost with industry benchmarks, potential areas for improvement can be identified. This includes examining factors such as labor productivity, labor rates, and labor efficiency. By understanding industry standards, Mordica Company can set realistic targets for improvement.

Strategies for Alignment

To align Mordica Company’s standard labor cost with industry standards, several strategies can be implemented. These strategies may include:

- Implementing lean manufacturing principles to reduce waste and improve efficiency.

- Investing in employee training and development to enhance skills and productivity.

- Optimizing production processes to minimize labor requirements.

- Negotiating competitive labor rates with unions or employees.

- Benchmarking against industry leaders to identify best practices and implement them.

By implementing these strategies, Mordica Company can align its standard labor cost with industry standards, leading to improved efficiency, competitiveness, and profitability.

Questions Often Asked

What is Mordica Company Standard Labor Cost?

Mordica Company Standard Labor Cost is a predetermined amount assigned to each unit of production, representing the estimated labor cost under normal operating conditions.

How is Mordica Company Standard Labor Cost calculated?

Mordica Company Standard Labor Cost is calculated by multiplying the standard labor hours per unit by the standard labor rate.

What factors influence Mordica Company Standard Labor Cost?

Factors influencing Mordica Company Standard Labor Cost include labor market conditions, production methods, and employee efficiency.

How does Mordica Company Standard Labor Cost impact its operations?

Mordica Company Standard Labor Cost influences production planning, cost control, and performance evaluation, providing a basis for budgeting, variance analysis, and continuous improvement.