Yan yan corp has a 2000 par value bond – Yan Yan Corp. has issued a bond with a par value of $2,000, setting the stage for an in-depth exploration of its characteristics, valuation, and market performance. This bond, with its distinctive par value, presents a compelling case study for examining the intricacies of fixed income securities.

The par value of a bond represents its face value, the amount that the issuer promises to repay at maturity. In the case of Yan Yan Corp.’s bond, the $2,000 par value signifies the principal amount that investors will receive upon the bond’s maturity date.

This par value plays a pivotal role in determining the bond’s price, yield, and overall attractiveness to investors.

Bond Overview

Bonds are financial instruments that represent a loan made by an investor to a borrower, typically a corporation or government. Bonds have a fixed maturity date and pay regular interest payments to the investor. The par value of a bond is the face amount or the principal amount that the investor will receive at maturity.

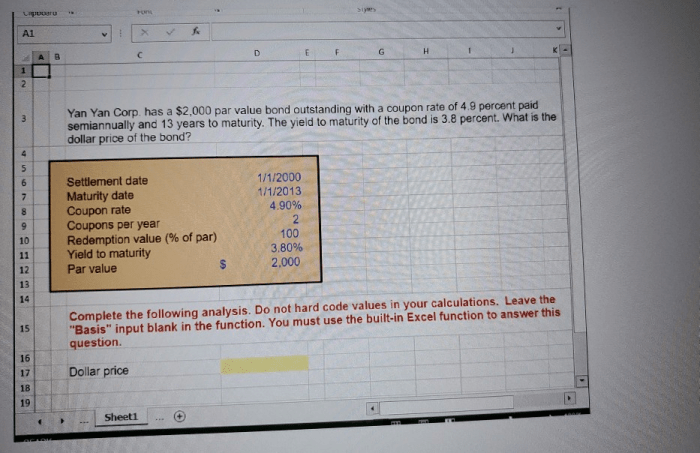

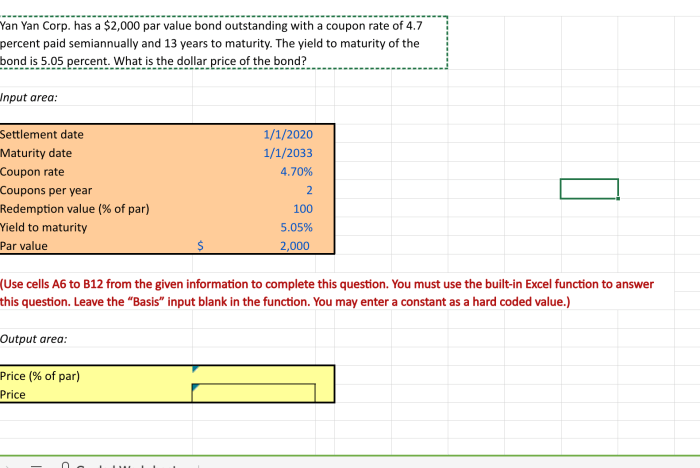

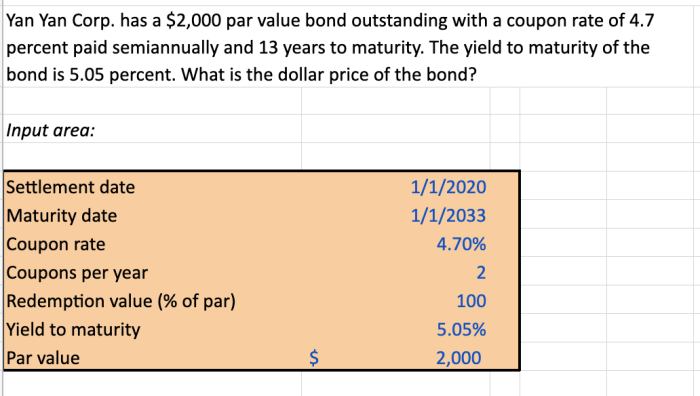

Yan Yan Corp. Bond Characteristics

Yan Yan Corp. has issued a bond with a par value of $2,000. The par value represents the amount that the investor will receive at the maturity date of the bond. The par value is significant because it determines the amount of interest that the investor will receive over the life of the bond.

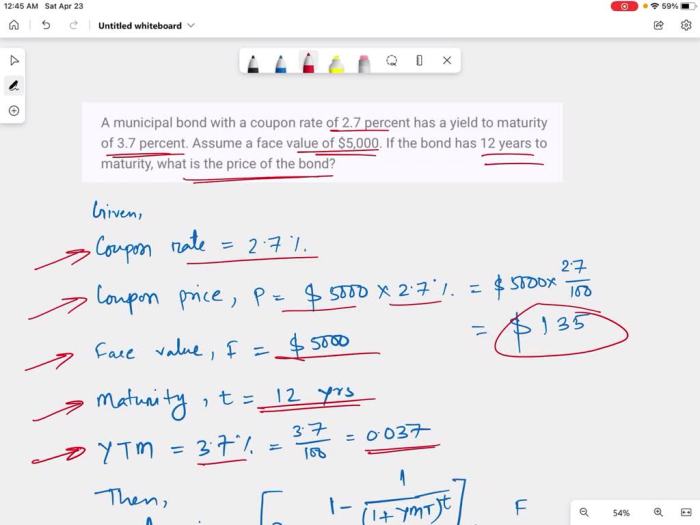

Bond Valuation and Pricing

The par value of a bond is an important factor in determining its price. The price of a bond is typically quoted as a percentage of its par value. For example, a bond with a par value of $2,000 that is trading at 98% of par would have a market price of $1,960. The price of a bond can fluctuate over time based on factors such as interest rates, credit risk, and market demand.

Common Queries: Yan Yan Corp Has A 2000 Par Value Bond

What is the significance of the $2,000 par value for Yan Yan Corp.’s bond?

The $2,000 par value represents the principal amount that investors will receive upon the bond’s maturity date. It serves as a benchmark against which the bond’s market price can be compared, providing insights into factors influencing bond valuation.

How does the par value impact the bond’s price?

The par value is a key factor in determining the bond’s price. Bonds are typically issued at or near their par value, and their market price will fluctuate based on factors such as interest rates, creditworthiness of the issuer, and market demand.

What are the risks associated with investing in Yan Yan Corp.’s bond?

Investing in any bond carries certain risks, including interest rate risk, credit risk, and inflation risk. Investors should carefully consider their risk tolerance and investment goals before investing in Yan Yan Corp.’s bond.